Blog

Latest News

Unique Planning Opportunity for Disabled or Chronically Ill Beneficiaries

There is great news for clients with certain family members or other beneficiaries – this year brought a significant change in the law that benefits beneficiaries who are disabled or chronically ill. The Setting Every Community Up for Retirement Enhancement (SECURE) Act became law.

Has Your Stimulus Check Been Taken by the Nursing Home?

As we all know Congress has authorized stimulus payments to be made to those eligible persons. The CARES Act provides $1200 for individuals, $2400 for joint taxpayers and taxpayers with children with $500 for each child...

Court Decisions Holding Personal Representatives of Estate and Trustee Personally Responsible For Taxes

Recently the United States Tax Count issued several decisions regarding the tax liability of transferees. The transferees were individuals who received distributions from transferors, which were corporations which sold their assets and then made distributions ...

Special Needs Trusts: Important Update

A properly drafted and funded special needs trust can enhanced your loved one’s life for a lifetime – just what you want for your child

Devilish Details Make All the Difference

Too many clients undermine their own wishes because they overlooked these details.

The First Interview with Your Estate Planning Attorney is Critical

Sometimes that initial interview can become very emotional, and you should be prepared for that. The result will be a plan that reflects your real desires and meets the needs of your loved ones.

Pending Legislation Will Help Seniors

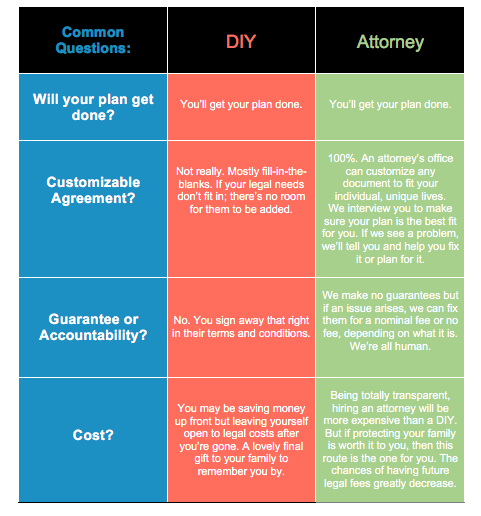

DIY Estate Planning?! More Risks Than You'd Think...

Sadly, the consequences of DIY estate planning may not be discovered until you die when you won’t be around to sort out the problems and your loved ones may be left with a mess to untangle.

Heads Up: A New Government Benefit May be Coming Your Way

Nursing Homes May Be Banned From Using Pre-Dispute Binding Arbitration Agreements

A proposed rule from the Centers for Medicare & Medicaid Services (CMS) would mean nursing homes cannot force new residents to agree to binding arbitration rather than going to court over a future dispute. Public comments are open utnil Sept. 16.

Learn from the Rich and Famous

If you have family business you want to keep private, we encourage you to work with us to pass along your assets easily, cheaply and privately using a trust-based plan.

Protect Your Stepchildren in Your Plan

In general, a child is not considered the step-parent's legal heir ... so that child is not legally entitled to any of the parent's estate.

Understanding the Guardianship Process

Planning for incapacity means taking the time today – while you have a clear head – to make decisions about who you want to help you if you need assistance.

Supreme Court Decides Trust Taxation Case

The Supreme Court decides so few cases that lawyers, courts and agencies will look to this case for guidance on the taxation of trusts and beneficiaries in the interstate context for years.

Will You Be Caught in the Middle-Class Bind?

... too wealthy for government help and too poor to do without it ...

When Your Child Gets Married - Again!

Even if your child leaves money and assets to a second – or third, fourth – spouse, the money in your trust is separate and goes to your grandchildren.

Don't Forget: You Must Fund Your Trust!

Trust-based planning requires your active participation in the planning process as well as in funding the trusts we create.

Observation Status and Medicare: Update

The court case (Alexander v Azar) speaks to the fact that patients have no easy way to challenge the observation status designation – and many patients would save thousands of dollars if they could change the designation.

Special Needs Trusts Can Help Newly Disabled Manage Income from a Court Settlement

Using the settlement to fund a Special Needs Trust (SNT) is a way to maintain access to government benefits (Medicaid or Supplemental Security Income) and have access to settlement funds.