DIY Estate Planning?! More Risks Than You'd Think...

Are you a fan of Do It Yourself?

What would you do by yourself?

- Assemble a dresser from Ikea?

- Sew a dress?

- Paint the deck?

- Fix the toilet?

- Color your hair?

- Install a shower?

- Rewire the lighting?

- Check a weird skin spot for cancer?

- Draft your will or estate plan?

Each of us will have a line in the sand when it comes to DIY. As estate planning professionals we hope you put DIY wills and estate plans in the same category as cancer screenings. Here’s why.

DIY wills are simple – which is attractive – but they are often too simple. Here’s a quick example.

An elderly woman wants to leave her assets to her two children. She has a home worth $300,000 and a bank account with $300,000. So, she does a DIY will leaving the house to her son and the money to her daughter. However, when she dies ten years later, the bank account has dwindled because she had living expenses and the house’s value has ticked up. So, her daughter gets $100,000 in cash and her son gets a house worth $325,000.

Is that what Mom intended? Will the son step up and share? Will the daughter sue her brother? Sadly it happens! The result is squabbling children, sour feelings and probably an outcome Mom did not want.

A qualified estate planning attorney would have anticipated this situation and made appropriate recommendations so the children inherited equally -- as Mom wanted.

There are other situations that a DIY will cannot address.

- A will does not supersede beneficiary designations you may have made years ago when you bought your life insurance policy or established your IRA. So, even if you state in your DIY will that you want to divide everything evenly among your children, those items that already have beneficiaries will be left out. An estate planning attorney will review those accounts with you to make sure they are current and that your distribution plan takes them into account.

- Online wills default to a specific state for the applicable law. Most states have specific requirements about witnesses, whether the will must be notarized and even what color ink is acceptable. Without a state-specific expert to consult, a do-it-yourself document may leave everything as you intended, yet not meet all the formalities of state law, making the will invalid, sending your family to probate and possibly forcing them to hire an attorney -- or two -- to handle probate in one state while applying the laws of another state.

We’ve focused on wills because to the layperson, they seem to be pretty simple and those do -it-yourselfers often start there. Hopefully these examples show that legal documents are rarely simple. The other components of a true estate plan – trusts, powers of attorney, advanced medical directives – are much more complicated. DIY plans cannot guide you through the nuances of these important documents but making mistakes can have expensive and serious consequences.

Sadly, the consequences of going the DIY route may not be discovered until you die when you won’t be around to sort out the problems and your loved ones may be left with a mess to untangle.

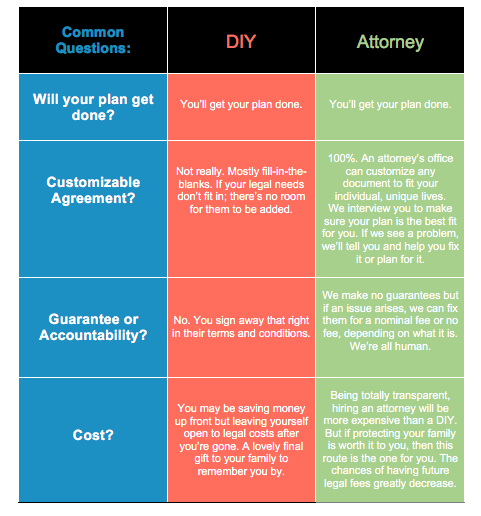

Working with an estate planning attorney will give you peace of mind that your legal needs are being met with a customized, detailed plan that reflects your wishes and protects you and your family. We are able to evaluate your situation and formulate a plan that best fits your unique situation. Give us a call for a free consultation.